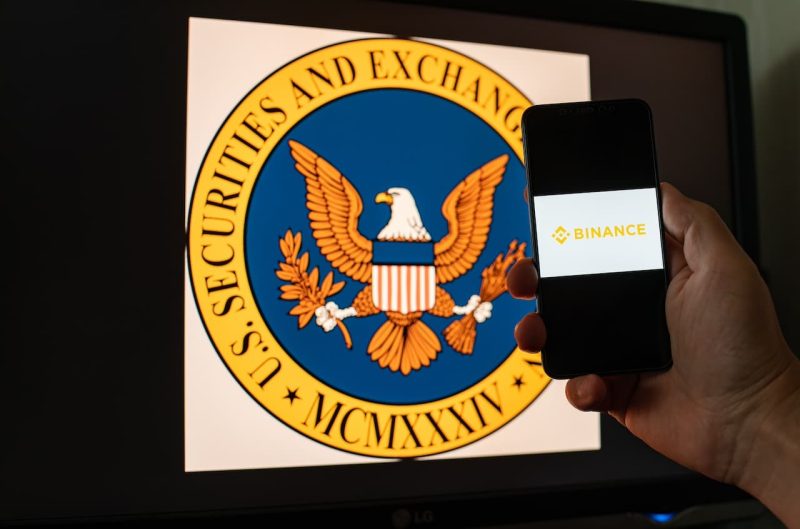

The ongoing legal battle between the US Securities and Exchange Commission (SEC) and Binance has taken a new turn after the federal judge in the case ordered a court review on the classification of digital assets as securities.

In a minute order from January 18, Judge Amy Berman Jackson expressed her intent to hear arguments regarding how the SEC treats crypto within the existing regulatory and legal frameworks.

“The Court intends to hear argument on this point, and on whether the SEC “misunderstands the meaning of ‘scheme’ in Howey,” the order said, referring to the so-called “Howey test” that is used in the US to determine whether an asset is a security or not.

It added:

“The Court assumes from the organization of the memoranda that counsel for Binance Holdings Limited or Zhao intends to address whether the SEC has plausibly alleged the existence of any investment contract with respect to BNB, BUSD, the Third Party Tokens, BNB Vault, and Simple Earn […].”

Further, the court order said that it wants to know whether a digital asset, under current rules, can remain “a security in perpetuity” when it trades on the secondary market after it has been sold by the original issuer.

Lawyers representing Binance’s American branch, Binance.US, will now be given the opportunity to address the issues, including whether an investment contract – also known as a security – necessitates a contractual undertaking.

Further, the court will address background questions about the appropriateness of litigation as the SEC’s method for overseeing the crypto industry.

Former SEC Chair: ‘Vast majority’ of tokens are securities

The development comes in the wake of comments from former SEC Chair Jay Clayton, who in October last year said the “vast majority” of digital tokens “would fall within the definition of a security in America.”

Sharing the same sentiment, current SEC Chair Gary Gensler in June last year also hinted that he believes crypto assets should be considered securities, saying:

“There’s nothing about the crypto securities markets that suggests that investors & issuers are less deserving of the protections of our securities laws.”

There’s nothing about the crypto securities markets that suggests that investors & issuers are less deserving of the protections of our securities laws.

Congress could have said in the 1930s that the securities laws applied only to stocks & bonds.

For more, read my remarks:

— Gary Gensler (@GaryGensler) June 12, 2023

The post Judge to Address in Binance Case: Are Cryptocurrencies Securities Under U.S. Law? appeared first on Cryptonews.